Contents

Disclosures on the Sustainability risks, principle adverse impacts and remuneration policy (in accordance with the Regulation (EU)2019/2088 (SFDR), are integrated in Forbion's Policy for Responsible Investments: BioEconomy.

Fund Level Disclosures

For the purposes of article 10(1) of the SFDR, Forbion considers Forbion BioEconomy Fund I Coöperatief U.A. (the Fund), managed by FCPM III Services B.V. (the Manager), a financial product which promotes environmental and social (E/S) characteristics, as referred to in article 8 SFDR:

A. Summary

The fund is focused exclusively on companies that apply biotechnology to industries; i.e. in the materials and environmental technologies space, and the food and agricultural space. All Fund investments promote environmental and/or social (E/S) characteristics and contribute to specifically SDG 8, SDG 12 and/or SDG 13. The fund does not make any sustainable investments pursuant to article 9 SFDR.

Prior to investing, companies' potential impact on planet is assessed based on Forbion’s proprietary PLANET Impact Score. This framework considers the positive contribution of portfolio companies to the global planetary challenges. An investment needs to exceed a pre-specified minimum score to become eligible for investing. Furthermore, each company needs to sign up to the Forbion ESG Investment Principles: BioEconomy and endorse Forbion’s Policy for Responsible Investments: BioEconomy and the Manager’s Diversity, Equity and Inclusion Policy prior to investing.

To monitor said E/S characteristics, the manager of the fund has formulated specific KPIs, which form part of quarterly and annual reporting by the companies the fund invests in. Additionally, through board positions improvement on KPIs, and good governance are endorsed.

The Manager will use various data sources provided by the company to analyze its eligibility and monitor it post-investment. Company data is verified against the Manager’s in-house team of scientifically qualified and experienced investment managers, and relevant external sources, including market data, key-opinion-leaders, and co-investors.

The fund does not use any indices as reference benchmarks.

B. No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

C. Environmental or social characteristics of the financial product

In making its investments for the Fund, the Manager considers the positive impact of its investment decisions on the planet and society. The Fund, in particular, will contribute to the following three of the Sustainable Development Goals (SDG) set by the United Nations:

- SDG 8 – Decent Work and Economic Growth

- SDG 12 – Responsible Consumption and Production

- SDG 13 – Climate Action

Companies that fall within the Forbion BioEconomy strategy will contribute to at least one of the above-mentioned SDGs. In addition, individual portfolio companies may contribute to other SDGs, such as SDG 2 (Zero Hunger), SDG 6 (Clean Water and Sanitation), SDG 9 (Industry, Innovation and Infrastructure) or SDG 15 (Life on Land).

The Fund is an investor focused exclusively on companies applying biotechnology to industries in the materials and environmental technologies space, and the food and agricultural space. The environmental and social characteristics promoted by the Fund are attained by considering the impact of the Fund’s decisions on environment and society by focusing on:

- Solutions that clean the planet and feed the population

- Replace existing production methods with biotech-enabled processes.

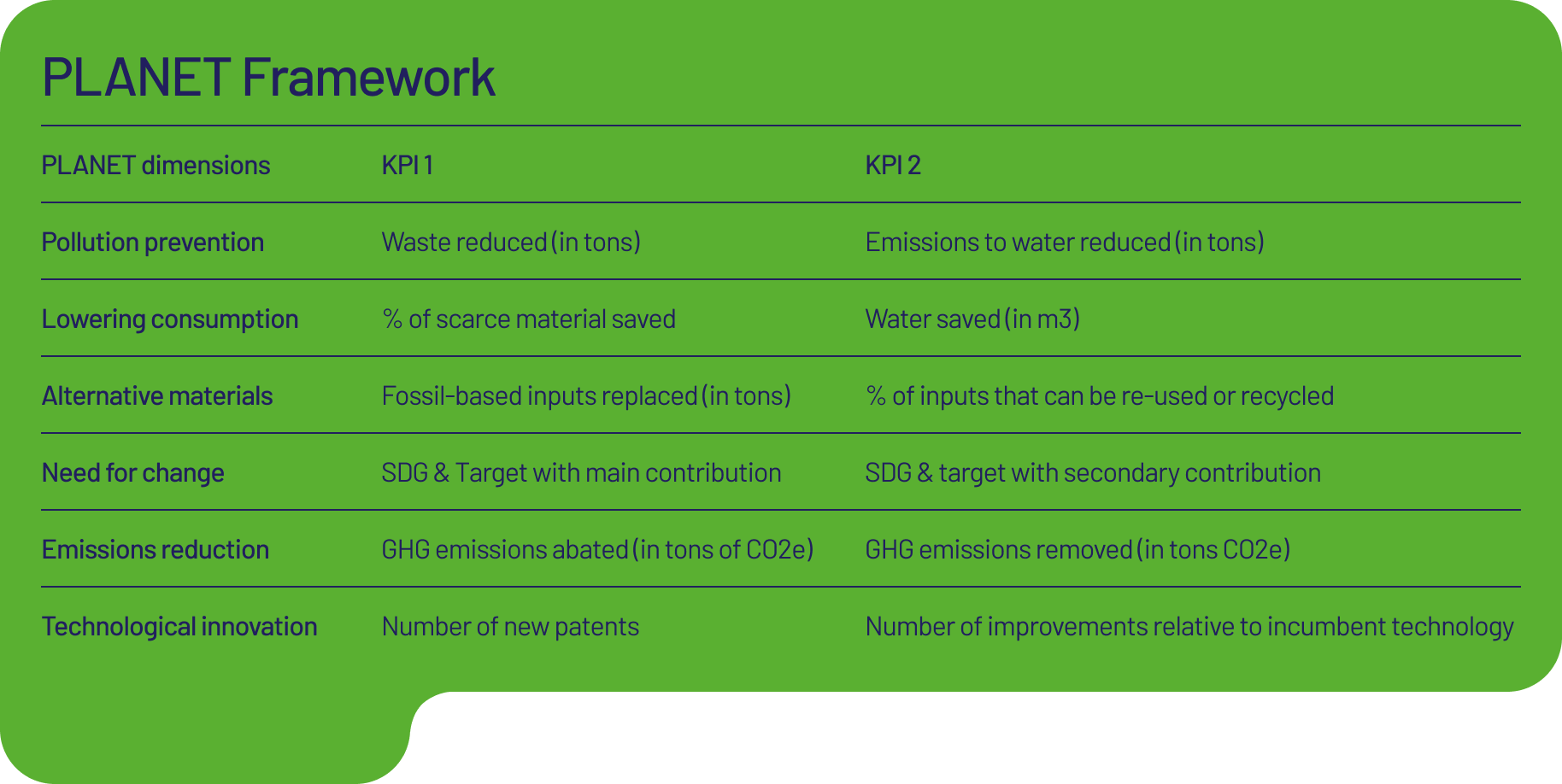

In order to monitor impact and drive accountability, the Manager uses the so-called PLANET Framework. This framework scores the impact of companies across six criteria with respective KPIs. At least two KPIs directly related to the six criteria of the PLANET Framework will be defined for each investment to monitor its expected impact annually. These KPIs are presented in the table below.

As part of the investment management process, prior to investing the Deal Team reports on all relevant impact and ESG elements to the Investment Committee and to the Manager by delivering the PLANET Impact Score and a signed deed of adherence to Forbion BioEconomy’s ESG Investment Principles, addressing i.a. good governance. The average PLANET Impact Score of an investment made by the Fund shall not be lower than 4 (minimum of 20 in total). For each investment that exceeds the minimum PLANET score, five dimensions of impact are further analyzed in detail. The PLANET Framework scoring methodology is set forth below.

In addition to the PLANET Framework, the Manager has formulated ESG Key Performance Indicators (KPIs) that are material to portfolio companies. These KPIs form part of the engagement with both portfolio companies and subsequent reporting back to our investors.

D. Investment strategy

The Fund’s investment strategy is to deliver financial returns alongside impact. We aim to realize this by investing in private companies across two themes (i.e. (i) clean the planet and (ii) feed the population) and across two strategies:

1) Enable Strategy and

2) Grow Strategy.

The Manager will apply well-defined investment processes starting with deal-sourcing up until exit management and post-exit reporting. Especially after deal-sourcing of investment opportunities, the Manager will apply a list of concrete investment criteria to select the investments that will have environmental and/or social characteristics.

- The Manager will only review companies that are a fit for the two themes of the Fund: clean the planet and feed the population.

- The PLANET Framework will be applied to the Fund that only invests in companies reaching a minimum PLANET Impact Score (>20).

- The Fund will only invest in companies adhering to Forbion BioEconomy’s ESG Investment Principles.

- Post investment, the Manager will periodically collect KPIs from the companies for monitoring purposes and reporting purposes to its investors as part of quarterly reporting.

After a successful exit event, the Manager will conduct an exit report, consisting of both financial returns to the fund as well as impact-related, quantified returns to environmental and/or social characteristics.

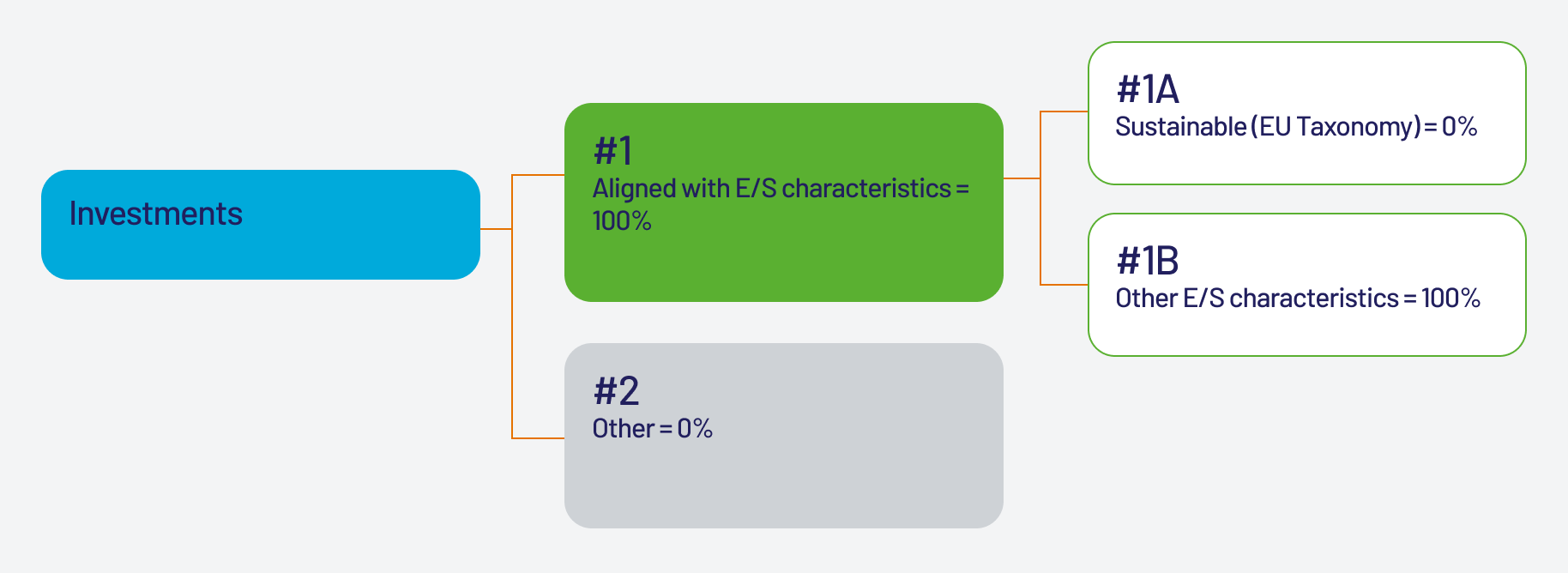

E. Proportion of investments

The Fund is an exclusive biotech investor. For all companies it intends to invest in it requires an average PLANET Impact Score of at least 4 and adherence to Forbion BioEconomy’s ESG Principles, prior to investing. 100% of investments will promote E/S characteristics. Of those investments, 0% will be aligned to the EU Taxonomy.

F. Monitoring of environmental or social characteristics

Post-investment, in the value creation stage, we help our companies set up their ESG frameworks and deliver on their impact potential. We will formulate ESG KPIs that we believe are material for the target Forbion BioEconomy sectors and specifically for our portfolio companies and their stage of maturity.

Forbion BioEconomy is committed to monitoring and managing material ESG factors related to its portfolio companies. The analysis conducted by the team ahead of a potential investment during the pre-investment, due diligence phase, will be used to set a ‘baseline’ of relevant ESG factors. During the value creation, portfolio management phase, we aim to enable portfolio companies to monitor, measure and improve upon this baseline.

Furthermore, Forbion BioEconomy endorses good management of environmental factors in its portfolio companies from the outset. While the availability of relevant data at the initial stages of the portfolio may be limited, Forbion BioEconomy finds it important that portfolio companies become aware of their carbon footprint, potential biodiversity impacts, waste and pollution, resource efficiency and environmentally sustainable procurement.

Forbion BioEconomy puts great emphasis on the impact of its investments on people and our planet. With the aim of measuring and monitoring its overall impact, Forbion BioEconomy developed the PLANET Framework. For each investment that exceeds the minimum PLANET score, five dimensions of impact are further analyzed in detail (see section on Due diligence). At least two KPIs directly related to the six criteria of the PLANET Framework will be defined for each investment to monitor its expected impact annually.

To promote transparency and inform our stakeholders on our ESG and impact activities, Forbion BioEconomy will publish an annual ESG and impact report to highlight the portfolio companies’ advancements on selected PLANET Impact indicators and their progress with respect to key ESG factors. The analysis of the results of the annual survey will enable us to benchmark portfolio companies against their peers and track their performance over time. The results will also serve as input for our engagement with portfolio companies and subsequent reporting back to our investors.

G. Methodologies for environmental or social characteristics

In order to measure the attainment of the E/S characteristics, the Fund will report on the selected impact indicators listed in section C, on an annual basis. In addition, the Manager requires reporting on the ESG KPIs and endorses portfolio companies to improve their impact and ESG performance through the board positions held with portfolio companies.

To assess the performance of portfolio companies on impact and ESG, the Manager has developed a proprietary PLANET framework which considers well-established standards such as the Impact Management Project (IMP).

H. Data sources and processing

The sources of data used by the Manager are various. The annual ESG and impact performance data will be gathered using an annual impact and ESG surveys which will be sent to portfolio companies. The questionnaire will include questions material for portfolio companies and will request qualitative and quantitative data. Additional data might include, for example, Life Cycle Assessments (LCAs) provided by specialized 3rd parties, combined with market data. Early in the due diligence process, key opinion leaders in their field are engaged to give their views. Furthermore, information from co-investors is considered.

Data retrieved in the Investment Management Process are analyzed and assessed by the deal team of Investment Managers. Data is presented to the larger Investment Team and the final investment recommendation is presented to the Investment Committee of the Fund, which deliberates on this.

ESG KPIs are received and processed quarterly by the Manager’s Controllers and are part of the quarterly valuation discussions and review by the investment managers. Through PLANET Framework and the ESG KPIs, the Manager reduced the need for estimates where possible.

I. Limitations to methodologies and data

The Manager will collect data on E/S characteristics from companies during due diligence and through predefined KPIs in the post-investment stage at least annually. Companies within the investment scope of the Fund are in the early stages of development, because of which almost all collected data is typically self-reported and non-audited. The Manager, together with its external advisors, has extensive knowledge and experience in house to assess and process the data gathered to ensure its quality.

Consequently, the Manager does currently not foresee any limitations to the above-mentioned methodology and data sources. Continuous monitoring and engagement with portfolio companies will ensure the Fund’s investment team to be aware if any issues should arise.

J. Due diligence

In order to create economic and societal value, Forbion BioEconomy has integrated ESG and impact considerations in each stage of the investment process. We aim to enable portfolio companies to incorporate ESG policies and processes, aligned with industry best practice.

During due diligence, the investment team will thoroughly assess the impact potential and ESG status of each opportunity. For each investment that passes the PLANET Framework minimum score, the following five impact dimensions will be assessed in detail:

- WHAT outcome is a company contributing to?

- WHO are the stakeholders benefiting?

- HOW MUCH is the effect, and does it last?

- CONTRIBUTION by a company.

- RISK that impact will be different than expected.

Based on the assessment of the impact dimensions, at least two relevant impact KPIs will be proposed for each deal. These KPIs will be used to monitor and report on the impact achieved in the portfolio management phase.

Furthermore, the baseline assessment of each portfolio company’s ESG management will be conducted as part of the due diligence process. This initial assessment will form the basis for Forbion BioEconomy’s ESG Action Plan for each investment, which will be discussed and agreed upon with the company’s management team. Such a plan will include a set of ESG KPIs to be monitored by the Forbion BioEconomy team. These KPIs will depend on the company’s maturity and the complexity of its operations. Where possible, targets will be set for the selected ESG KPIs.

Simultaneously, we will apply Forbion BioEconomy’s ESG Investment Principles and exclusion policy, to help eliminate deals that do not comply with the Forbion Policy for Responsible Investments: BioEconomy. In this way, our investment managers are well positioned to make informed investment decisions, considering ESG factors and each investment's impact potential.

K. Engagement policies

The Manager works closely with investee companies (considering minority interest and associated lack of control) and has dialogue at senior management or board level. As a condition to investing, the Manager requires delivery of the signed Forbion BioEconomy ESG Investment Principles, including adherence to the Manager’s Policy for Responsible Investments: BioEconomy and the Manager’s Diversity, Equity & Inclusion Policy. In case the Fund is lead investor, it will always request a non-executive board or observer seat. Through the board representation at portfolio companies the Manager encourages its companies to improve their impact and ESG performance.

The Manager continuously monitors portfolio companies for sustainability risks, and adverse events that deviate from good governance practices. The Fund will (pro)actively engage with the board of a portfolio company to address, mitigate and preferably eliminate such risk. At the end of each calendar year, the Manager will conduct the annual impact and ESG survey. The results of the survey will be summarized and reported at the fund level. Based on the survey results, the Manager will engage with portfolio companies on ESG and impact topics that are the most material, present a potential risk and with potential for improvement. Where possible, the Manager will collaborate with co-investors on impact and ESG topics to leverage our influence and reduce the burden for portfolio companies.

L. Designated reference benchmark

The Fund has not designated an ESG index as a reference benchmark.