Contents

Disclosures on the Sustainability risks, principle adverse impact and remuneration policy (in accordance with the Regulation (EU)2019/2088 (SFDR), are integrated in Forbion's Policy for Responsible Investments.

Fund Level Disclosures

For the purposes of article 10(1) of the SFDR, Forbion considers that the following funds, managed by FCPM III Services B.V., are financial products which promote environmental and social characteristics, as referred to in article 8 SFDR:

- FFV 3 Feeder Coöperatief U.A.

- FFV 4 Feeder Coöperatief U.A.

- FFV 5 Feeder Coöperatief U.A.

- FFV 6 Feeder C.V.

- FGF I Feeder Coöperatief U.A.

- FGF I Lux Feeder SCSp

- FGF II Feeder C.V.

- Forbion CF II Co-Invest I C.V.

- Forbion Capital Fund III Feeder Coöperatief U.A.

- Forbion Capital Fund IV Feeder Coöperatief U.A.

- Forbion Capital Fund V Feeder Coöperatief U.A.

- Forbion Growth Opportunities Fund I Coöperatief U.A.

- Forbion Growth Opportunities Fund II Coöperatief U.A.

- Forbion Ventures Fund VI Coöperatief U.A.

- FORIIICAT Co-Investment Fund C.V.

- ForCal I Investment Fund C.V. - Class A

- Forbion Ventures Fund VII Coöperatief U.A.

- Forbion Growth Opportunities Fund III Coöperatief U.A.

All relevant Article 10(1) disclosures for the aforementioned funds are provided below.

A. Summary

The fund is an exclusive life sciences investor. All of the investments made by it promote E/S characteristics, specifically SDG 3 and SDG 8. The fund’s investment strategy is to invest in discovery through to advanced clinical development- stage private medicine development companies that discover, develop and commercialize therapeutics products addressing substantial unmet medical needs with the potential to significantly impact patient’s lives. The fund does not make any ‘sustainable investments’ pursuant to article 9 SFDR.

To monitor said E/S characteristics, the manager of the fund has formulated specific ESG KPIs, which form part of quarterly reporting by the companies the fund invests in. Additionally, through board positions improvement on KPI scores, and good governance are endorsed.

Prior to investing companies are scored on the basis of Forbion’s developed SUCCESS Score, which considers ESG criteria. A minimum average need to be scored to become eligible to investing. The fund has not designated an index as reference benchmark. Furthermore, companies need to sign an ESG checklist prior to investing, in which they also adhere to he fund’s Policy for Responsible Investments.

Data sources used to analyse eligibility and for continued portfolio management are various. Company data is verified against the manager’s inhouse team of scientific qualified and experienced investment managers, and external sources, including market data, key-opinion-leaders, and co-investors.

B. No sustainable investment objective

This financial product promotes environmental or social characteristics, but does not have as its objective sustainable investment.

C. Environmental or social characteristics of the financial product

In making its investments for the Fund, the manager of the Fund, FCPM III Services B.V. (the Manager) considers the impact of its decisions on patients and society. The Fund, in particular, contributes to two of the Sustainable Development Goals (SDG) set by the United Nations: “to ensure health and well-being for all” (SDG 3) and “to promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all” (SDG 8).

D. Investment strategy

The Fund’s investment strategy is to invest in discovery through to advanced clinical development-stage private medicine development companies of therapeutic products addressing substantial unmet medical needs with the potential to significantly impact patients’ lives. As part of the investment decision process, the investment manager reports on all relevant impact and ESG elements by completing the SUCCES score, keeping track of ESG metrics and ensures delivery of a signed ESG Check List, addressing i.a. good governance. We refer to Due Diligence for more detail.

We are noting that investments the Fund makes, are made in life sciences companies of relatively early stage where generally a limited number of people work and structures are yet to be set up. With this in mind, the Fund will endorse good governance committees in its portfolio companies. To endorse transparent financial reporting, the formation of an audit committee will be endorsed. The Fund will also endorse the formation of a remuneration committee to ensure transparency regarding the remuneration of senior management.

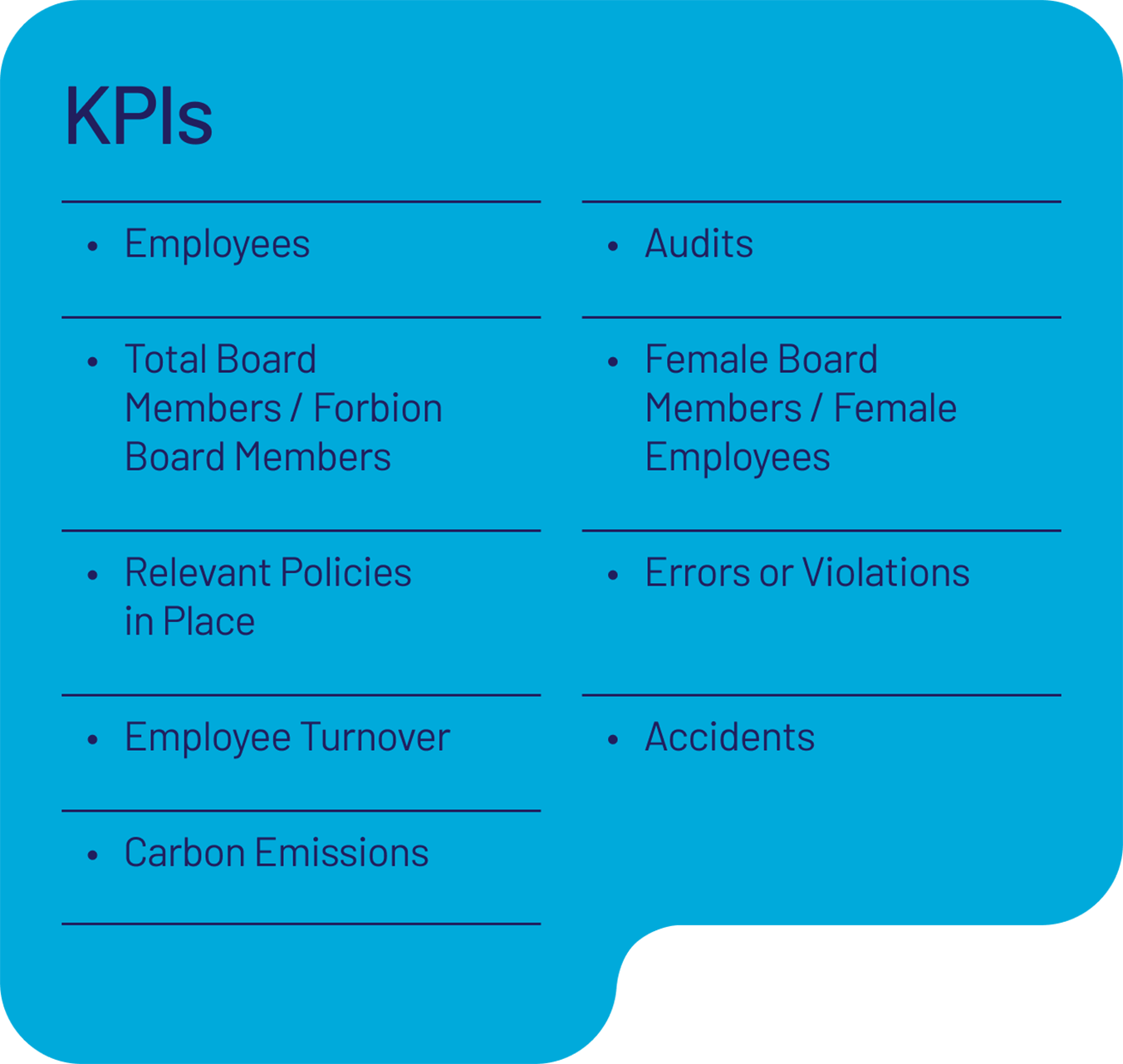

On the basis of ESG Key Performance Indicators (ESG KPI) reporting by portfolio companies, an ESG and Impact evaluation, including a tally of the number of jobs created and the number of patients that can be treated, is re-assessed at least annually. See for a list of the ESG KPIs Methodologies for environmental and social characteristics.

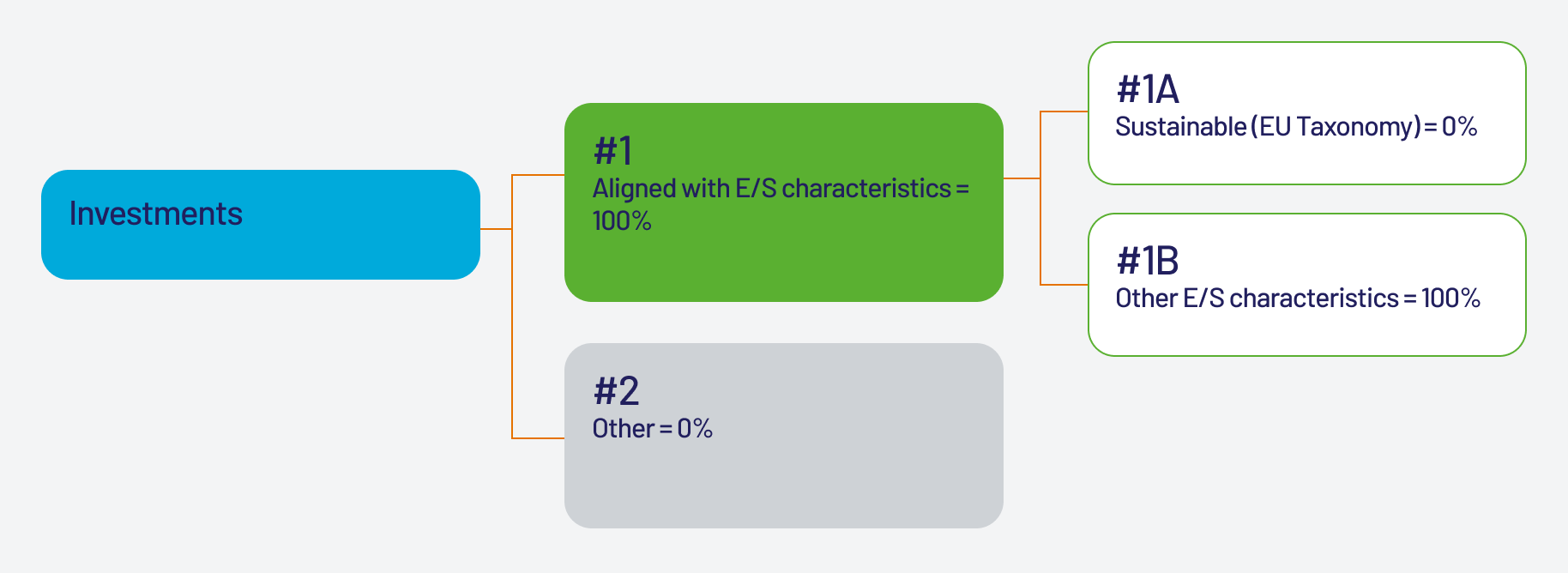

E. Proportion of investments

The Fund is an exclusive life sciences investor. All (100%) of its investments are used to attain SDG 3 and SDG 8 and therewith promote E/S characteristics. The Fund does not make any sustainable investments.

F. Monitoring of environmental or social characteristics

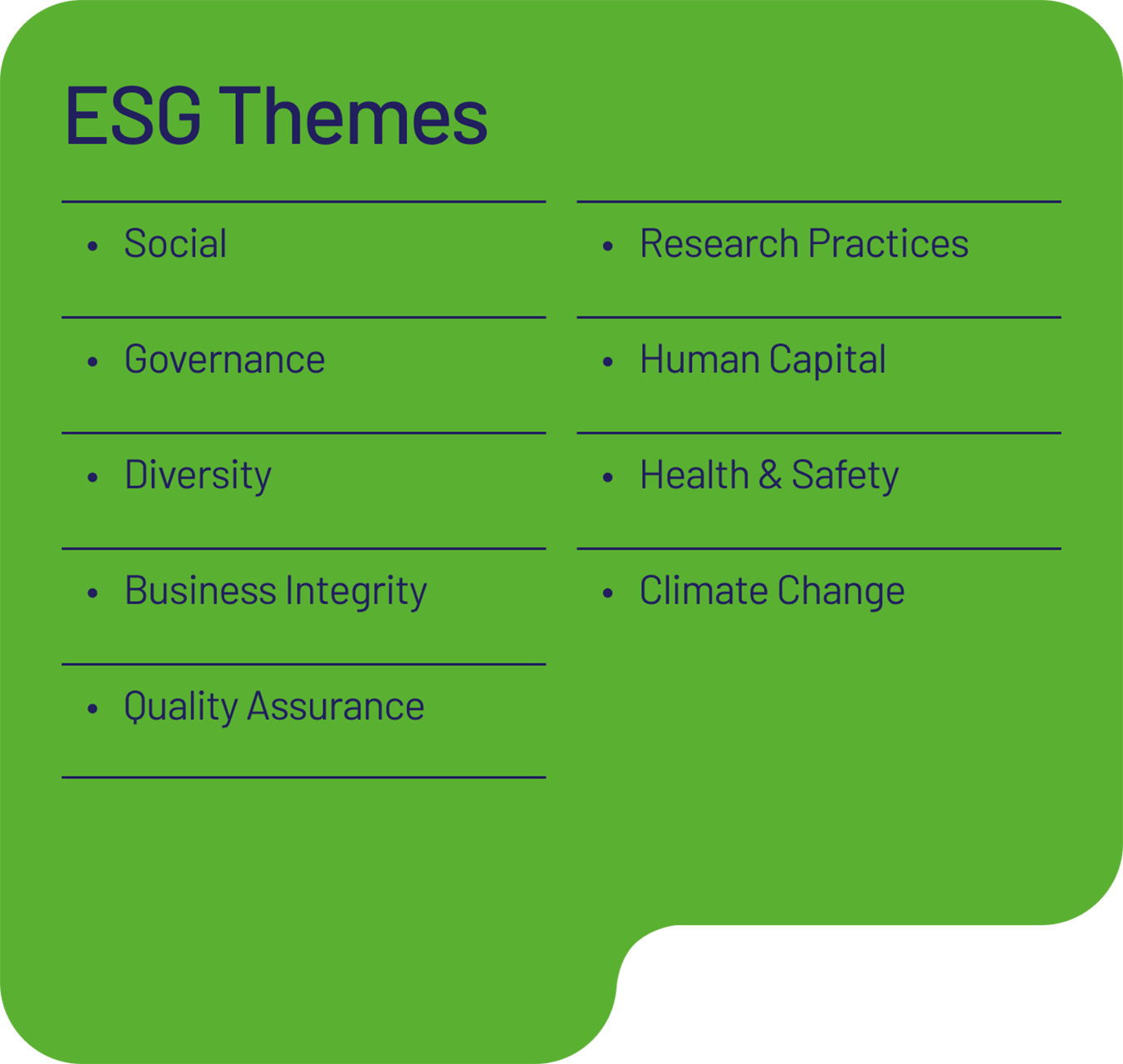

The Manager has formulated ESG KPIs that are material within the Pharmaceutical and Biotechnology industries and specifically to the Fund’s portfolio companies. These ESG KPIs form part of the engagement with portfolio companies and reporting back to the Fund’s investors in quarterly investor reporting.

As part of the Fund’s quarterly valuation process, which forms the basis of the quarterly investor reports, the ESG KPIs and Impact Score are reviewed on continued accuracy.

Annually, the Manager issues an Impact Report to Fund investors.

G. Methodologies for environmental or social characteristics

Not only does the Manager require reporting on the ESG KPIs, the Manager also endorses portfolio companies to improve their ESG KPI scores through the board positions held with portfolio companies. The ESG KPIs that are measured are:

The Impact Score used as part of investing consists of the following 7 criteria:

- Severity of disease

- Unmet medical need

- Cost-Savings potential

- Curative potential

- Environmental Social Governance impact

- Size of addressable patient population

- Significance of innovation.

H. Data sources and processing

The sources of data used by the Manager are various. Partially data stems from the life sciences companies the Fund intends to invest in. Additionally, market data is used. Early on in the due diligence process, key opinion leaders in their field are engaged to provide their view. Furthermore, information from co-investors is taken into account.

Quality of data of the life science companies is ensured through using external sources (from the market, key opinion leaders, co-investors) to verify data.

Data retrieved in the Investment Management Process are analysed and assessed by the deal team of Investment Managers. Data is presented to the larger Investment Team and the final investment recommendation is presented to the Investment Committee of the Fund, which deliberates on this.

ESG KPIs are received and processed on a quarterly basis by the Controllers.

ESG KPIs reported are part of the quarterly valuation discussions held with investment managers and are reviewed by them.

Given the combination of venture capital investing and the type of asset class - life sciences – the larger part of data on which assessments are made consists of qualitative data. Through i.a. its SUCCESS-Framework and the ESG KPIs selected, the Manager reduced its need for estimates where possible.

I. Limitations to methodologies and data

Venture capital life sciences investing requires foremost a qualitative approach to investing, different than a quantitative approach when investing in e.g. securitized loans. The Manager does make use of external data sources. We refer to Data sources and processing.

J. Due diligence

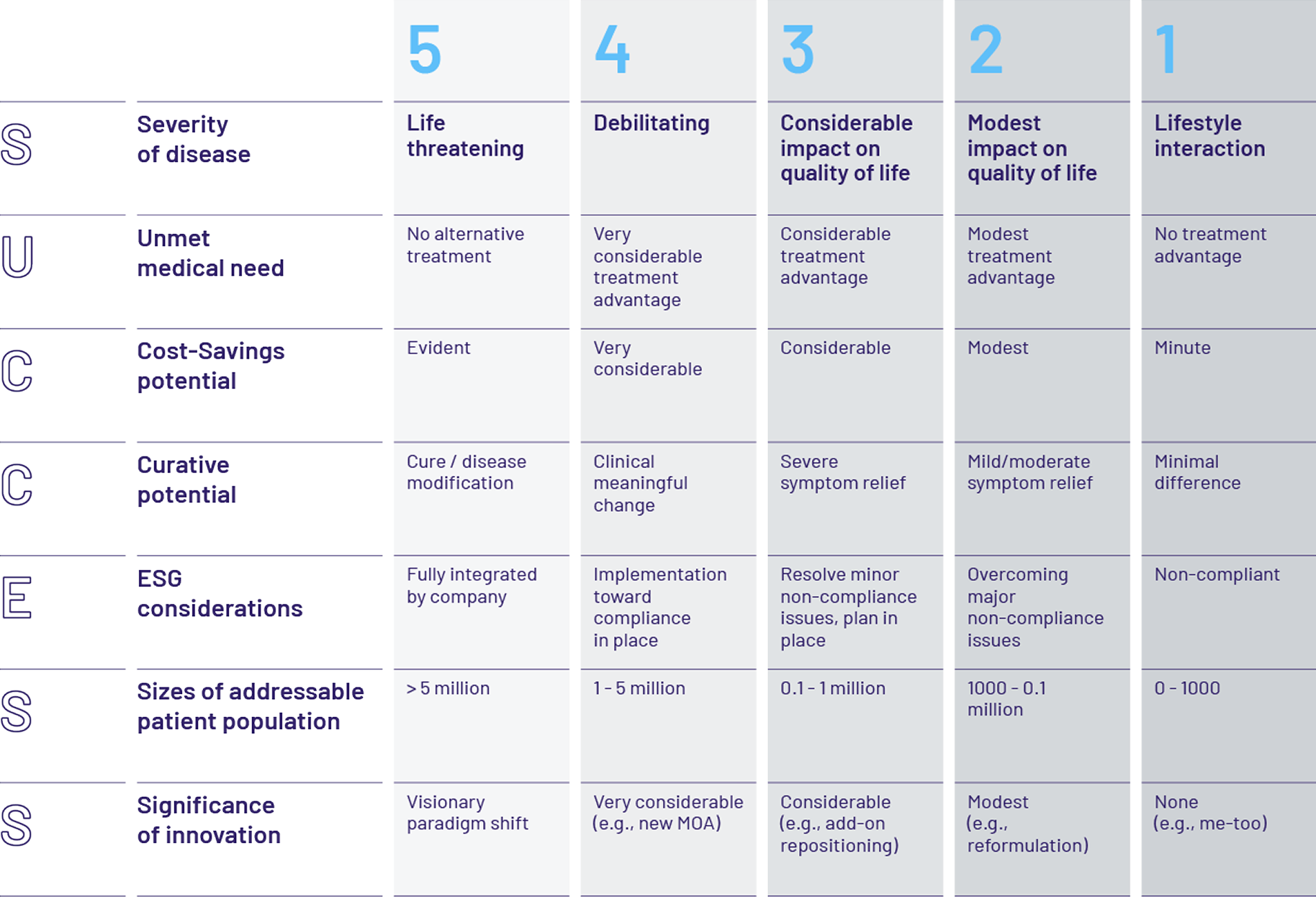

Prior to making an investment in a life science company, the Fund assesses such company on Impact against the Manager’s SUCCESS Framework.

With this SUCCESS Framework it scores the impact of companies across 7 criteria on a scale of 1 to 5. The average score on these 7 criteria results in an overall Impact Score. The 7 criteria are:

- Severity of disease

- Unmet medical need

- Cost-Savings potential

- Curative potential

- Environmental Social Governance impact

- Size of addressable patient population

- Significance of innovation

The average score of an investment made by the Fund shall not be lower than 3.9. Otherwise, the investment opportunity will be declined by the Manager.

The Manager also ensures delivery of a signed ESG Check List, addressing i.a. good governance.

For further details on the SUCCESS Framework and the ESG Check List, we refer to Forbion’s Policy for Responsible Investments.

K. Engagement policies

As a condition to investing, the Manager requires delivery of a signed ESG Check List, including adherence to the Manager’s Policy for Responsible Investments.

Through the board positions held with portfolio companies the Manager endorses portfolio companies to improving their KPI scores.

L. Designated reference benchmark

The Fund has not designated an ESG index as a reference benchmark.